are property taxes included in mortgage in texas

Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate. Homeowners are responsible for paying their property taxes directly to the.

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

If you qualify for a 50000.

. A standard mortgage payment usually includes. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Are Property Taxes Included In Mortgage In Texas.

If you own real estate in. This calculation only includes principal and interest but does not. If you pay your mortgage you are likely already paying your Texas property taxes.

The Texas Mortgage Credit Certificate provides qualified borrowers with up to 2000 per year in a federal income tax credit based on mortgage interest paid in the tax year. The amount each homeowner pays per year varies depending on. Property taxes are included as part of your monthly mortgage payment.

The new Tax Cuts and Jobs Act took effect on January 1. Whether you pay toward property taxes each month through a mortgage escrow account or just once-yearly directly to your local government is a choice youll make. Updated September 18 2022.

Amended tax returns not included in. Paying property taxes is inevitable for homeowners. Tax Code Section 3101 requires the assessor to prepare and mail a tax bill to each property owner listed on the tax roll or to that persons agent by Oct.

However it is generally speaking property taxes are not included in the mortgage payment in Texas. There is no definitive answer to this question as it can vary depending on the mortgage lender and the specific terms of the. The average effective property tax rate in California according to the Bureau of Economic Analysis is 073 while the national average is 107.

21 Are property taxes included in mortgage in Texas. If you dont you put yourself at risk of mortgage liens or foreclosure. Are Property Taxes Included In Mortgage Payments.

With some exceptions the most likely scenario is that your lender. 1 or as soon.

Property Taxes And Your Mortgage What You Need To Know Ramsey

Property Tax In The United States Wikipedia

What Is An Escrow Account Do I Need One Austin Dallas Tx Trinity Title Of Texas

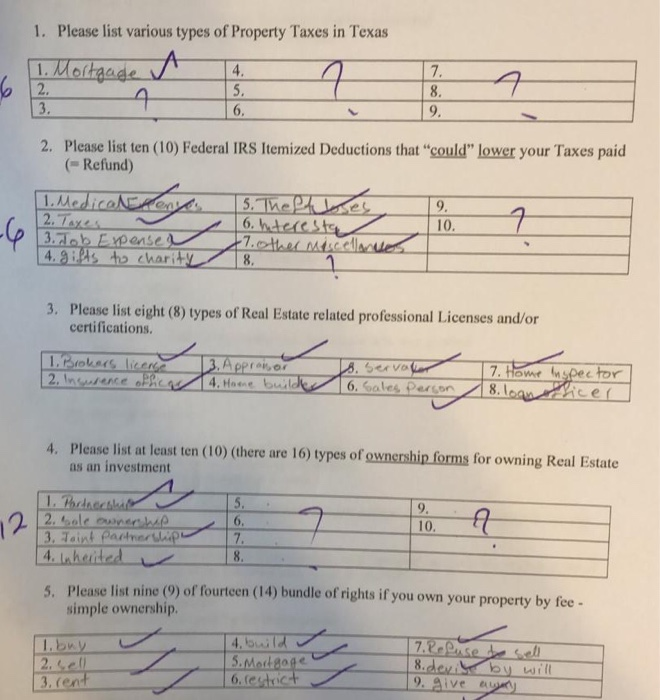

Solved 1 Please List Various Types Of Property Taxes In Chegg Com

How Property Taxes In Texas Work How They Differ How They Affect Your Monthly Mortgage Payment Jo Co Not Just Your Realtor Your Resource

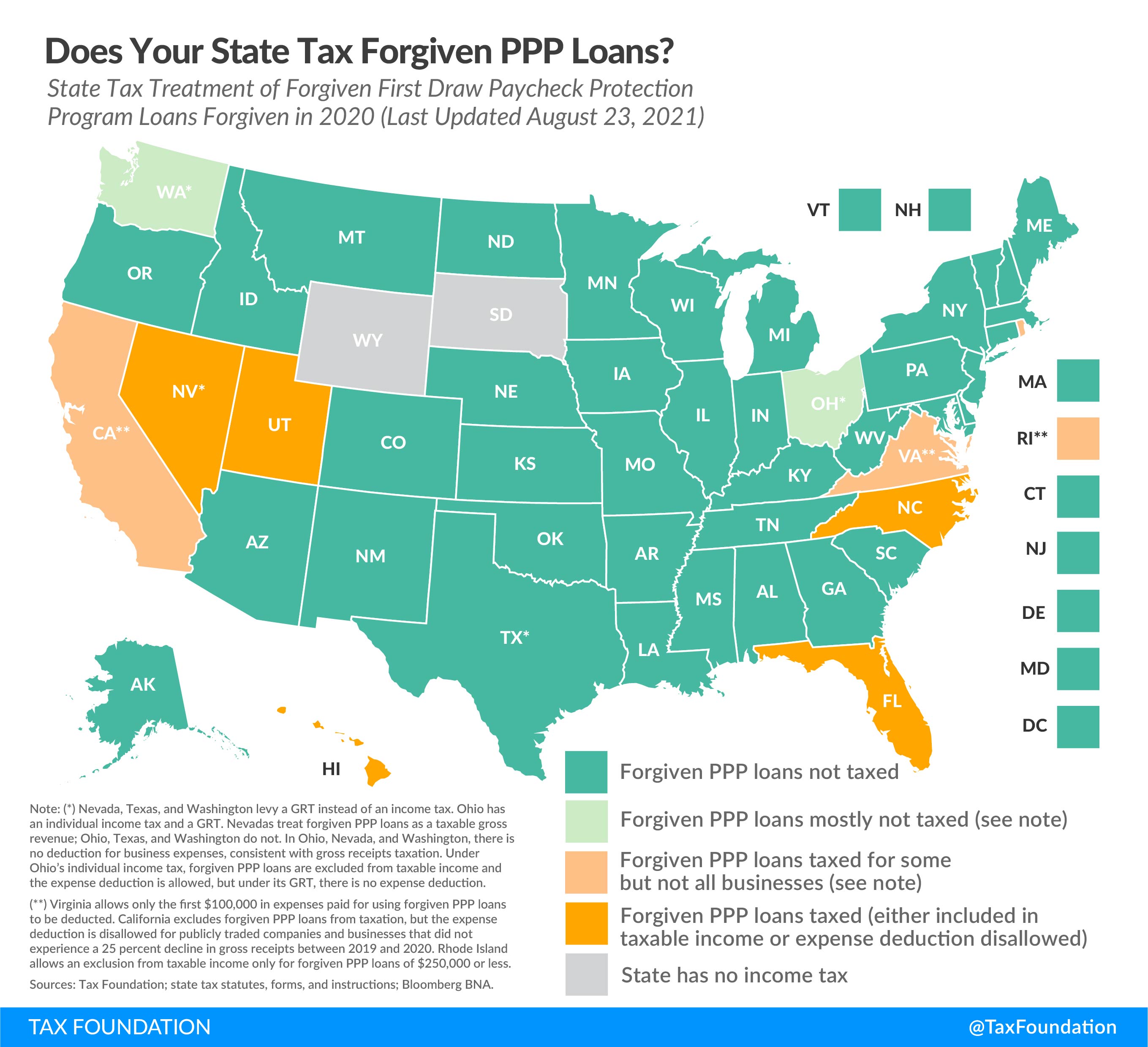

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

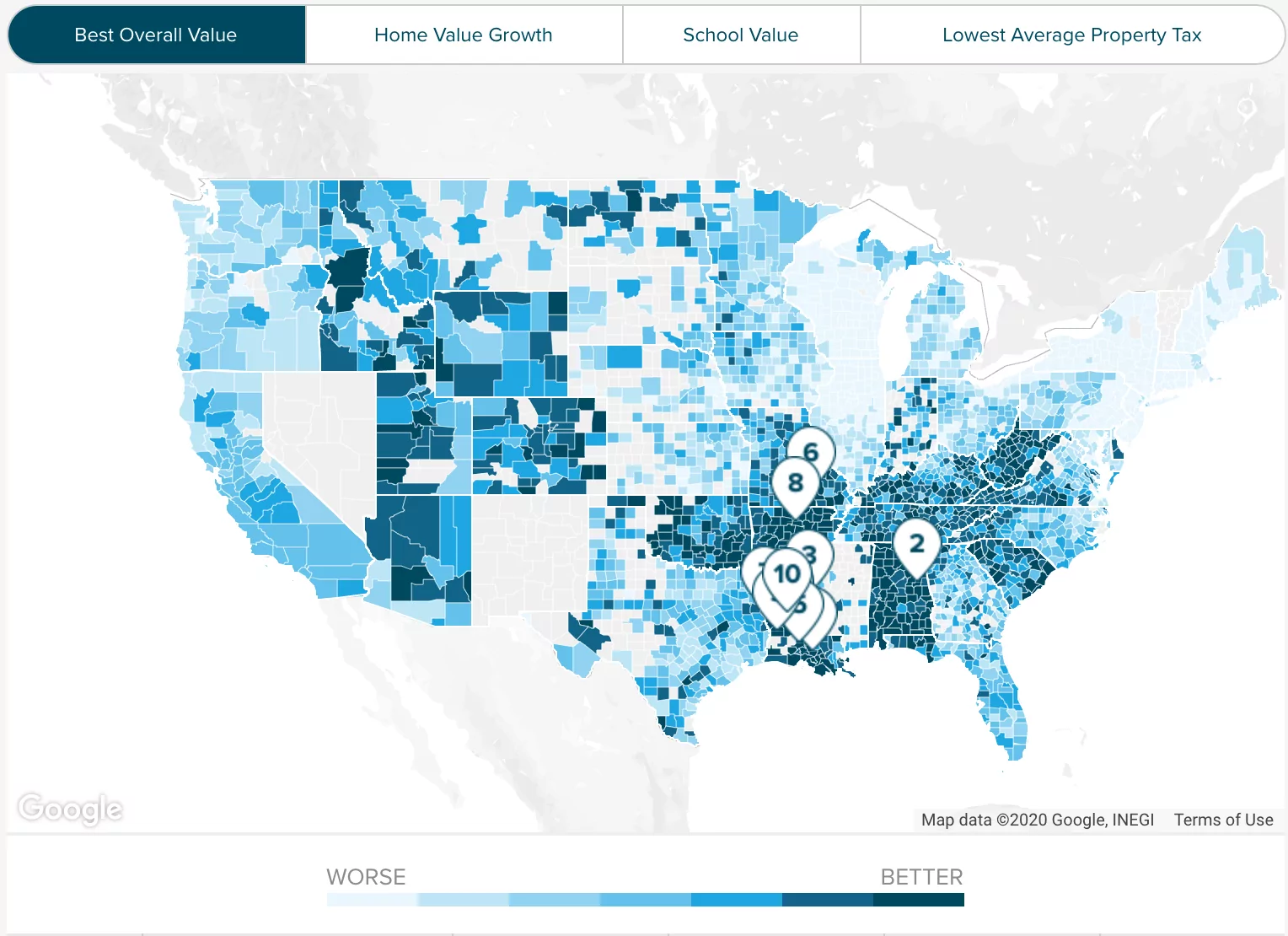

Property Tax Calculator Smartasset

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Riverside County Ca Property Tax Calculator Smartasset

New Texas Program Offers Homeowners Assistance Funds For Delinquent Mortgage Payments Property Taxes Community Impact

Property Taxes By State Highest To Lowest Rocket Mortgage

Mortgage Calculator Free House Payment Estimate Zillow

How To Use A Mortgage Calculator With Taxes In Texas

Georgia Morales Realtor W Texas Bound Real Estate The U S Tax Code Lets You Deduct The Interest You Pay On Your Mortgage Your Property Taxes And Some Of The Costs Involved

Is Property Tax Included In My Mortgage Moneytips

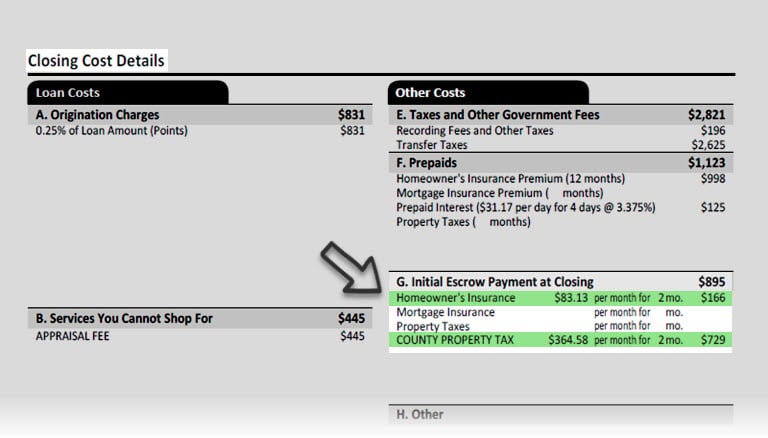

Prepaid Items Mortgage Escrow Account How Much Do They Cost

How To Tell If Your Taxes Are Included In Your Mortgage Pdx Home Loan

Mortgage Impounds Vs Paying Taxes And Insurance Yourself The Pros And Cons

New Funds Available To Texas Homeowners Facing Foreclosure The Senior Source